What You Need to Know About Third-Party Litigation Finance

- legalnoticereply

- Aug 18, 2025

- 8 min read

Have you ever had to walk away from a legal case just because the cost of fighting it was too high?

For many individuals and businesses, the price of justice can feel out of reach. Legal expenses, procedural delays, court filing fees, and ongoing lawyer charges quickly build up. As a result, even the strongest and most deserving legal claims often go unpursued. Cases may be dropped or settled for much less than their actual value, not because they are weak, but simply because they become too expensive to fight.

This is where third-party litigation finance steps in as a much-needed solution. It takes away the burden of legal costs and empowers claimants to seek justice without draining their financial resources. Over the past few years, this model has gained significant traction, especially in commercial and high-stakes disputes, by transforming how legal battles are financed.

In this blog, we unpack everything you need to know about third-party LF, what it is, how it works, who it helps, and why it is becoming a game-changing tool in India’s evolving legal and business environment.

What Does Third-Party Litigation Finance Actually Mean?

Third-party LF refers to a system in which a private entity, often a specialized funding company, agrees to pay for the legal expenses of a party involved in a lawsuit. This party, the funder, is not directly involved in the legal dispute. In return, the funder receives a portion of the recovered amount if the case results in a successful financial outcome.

This is not a loan. If the litigant loses the case, they are not obligated to repay the funder. The entire risk lies with the third party. It is this risk-sharing that makes the model powerful, as it allows legal action to be pursued based on merit rather than budget.

This arrangement is built on a strong legal and ethical foundation. The funder assesses the case independently and only chooses to fund matters that have a solid chance of winning. This ensures that weak or frivolous claims do not clog the system, while also giving claimants a strong financial partner to back their fight for justice.

How the Process Works in Real Life

When a litigant decides to explore litigation finance, they typically start by submitting key information about their case to a litigation funder. This includes documents like contracts, legal notices, invoices, and relevant communications. The funder then conducts a detailed assessment of the legal strength of the case, the enforceability of any judgment, and the financial potential of recovery.

If the funder finds the case viable, both parties enter into a formal agreement. This contract clearly outlines the roles and responsibilities, the types of expenses covered, and how the funder will be compensated if the case is won. It also ensures that the legal independence of the claimant and their lawyer is fully preserved.

After signing the agreement, the funder starts covering litigation costs such as lawyer fees, expert opinions, court filing expenses, and other procedural costs. The funder remains in close touch to monitor the progress, but all legal strategy decisions are left to the claimant and their legal counsel. This balance allows for professional support without compromising independence.

In the event of a successful outcome, whether through a court judgment, arbitration award, or negotiated settlement, the funder is paid their agreed share. If the case is unsuccessful, the claimant owes nothing. This makes litigation funding a no-risk, high-value proposition for those with meritorious claims.

Who Benefits from Litigation Finance and When

Litigation funding serves a broad spectrum of clients, but it is particularly valuable for businesses that face financial stress while dealing with commercial disputes. Many startups, early-stage companies, and SMEs have enforceable legal claims but lack the resources or risk appetite to pursue them. Litigation finance helps them bridge this gap.

It is equally useful for individuals involved in high-value legal battles, such as those related to real estate fraud, inheritance conflicts, or breach of contract. These cases often drag on for years and can exhaust the claimant emotionally and financially. Funding helps ensure that strong claims are not abandoned due to a lack of financial muscle.

Defendants, too, can benefit. If a company or individual is wrongfully sued or needs to mount a strong legal defense in a complex case, litigation funding allows them to do so without draining operational cash flow. As long as the case has merit and is supported by solid evidence, litigation funding is an effective option for both plaintiffs and defendants.

Large corporates also turn to litigation finance for portfolio-level management of disputes. Instead of using internal capital to fund every single case, they work with funders to strategically finance only those disputes with strong recovery potential, ensuring better allocation of legal budgets and improved return on litigation.

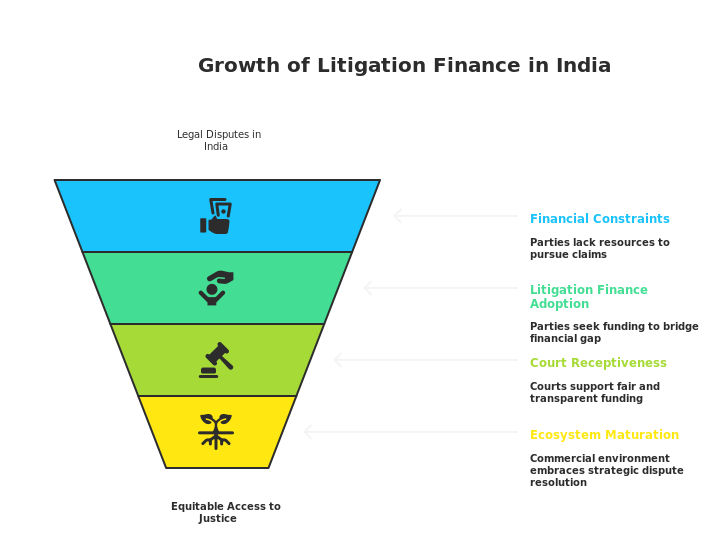

Why the Model Is Growing Rapidly in India

Although third-party LF originated in Western jurisdictions, its relevance in India has grown dramatically over the past few years. The Indian legal system is known for its delays and procedural complexity. Cases can run for years, and legal costs continue to rise across all practice areas. This has led to a growing appetite for smarter, alternative funding solutions.

Indian courts are also becoming more receptive to litigation finance, especially when the funder's role is limited to non-interference and the agreement is structured fairly. As long as the claimant retains control over legal decisions and there is transparency in the funding arrangement, courts have shown support for such models.

Moreover, India’s commercial ecosystem is maturing rapidly. Contract enforcement has become a priority for many businesses, and dispute resolution is now seen as a strategic need rather than an administrative headache. Litigation finance fits right into this transformation, making it easier for businesses to enforce contracts, recover dues, and resolve disputes in a commercially viable way.

Companies like LegalPay have led this transformation in India. With robust case evaluation systems, deep domain expertise in commercial disputes, and a wide network of legal professionals, LegalPay is helping build an ecosystem where justice is not dictated by who can afford it, but by who deserves it.

How Litigation Finance Helps Businesses Beyond the Courtroom

The benefits of litigation finance go beyond legal battles. For businesses, ongoing legal disputes can tie up funds, divert resources, delay expansion, and impact investor confidence. Litigation funding reduces this burden by covering legal costs and allowing the business to focus on growth and operations.

More importantly, it strengthens a company’s bargaining power. Opponents often stretch litigation in the hope that the claimant will back down due to rising legal costs. But when a business is backed by a litigation funder, it sends a clear signal that the claimant is financially prepared to see the case through. This often leads to faster and fairer settlements.

Litigation finance also supports strategic legal planning. Companies can evaluate multiple cases and pursue the strongest ones without internal budget pressures. This portfolio-style approach improves recovery rates, creates predictability in legal outcomes, and empowers legal teams to drive real business value.

Fundamentally, litigation finance turns legal claims from cost centers into potential revenue sources. By removing the upfront cost barrier and tying the funder’s fee to success, it aligns incentives and ensures that every case pursued is commercially sound.

What LegalPay Offers as a Litigation Funder

LegalPay stands at the forefront of litigation funding in India, offering not just capital but a comprehensive legal support system. It combines legal expertise, financial diligence, and a transparent funding structure to make dispute resolution smarter, faster, and less stressful for claimants.

The company operates on a no-win, no-fee model. This means clients only share a part of the recovered amount if the case is successful. There is no debt, no monthly payments, and no repayment in case of failure. This ensures complete alignment of interests between LegalPay and its clients.

Beyond funding, LegalPay helps connect clients with the right legal counsel, supports documentation, monitors timelines, and ensures that the case stays on track. It also maintains strict confidentiality and works within all ethical and regulatory boundaries. With a growing track record across sectors, LegalPay is becoming the preferred choice for litigation finance in India.

Its focus on recovery, commercial disputes, and arbitration makes it especially suited for businesses dealing with complex legal matters. LegalPay’s data-backed risk evaluation and rapid onboarding process further differentiate it in an industry that is often perceived as slow and complicated.

Clearing the Air Around Common Misunderstandings

Despite its benefits, litigation finance is sometimes misunderstood. One common myth is that the funder takes control of the case. This is not true. The client and their lawyer remain in full control of the legal strategy. The funder only provides financial support and receives updates but does not interfere in any legal decision-making.

Another concern is about the complexity or speed of the funding process. In reality, funders like LegalPay provide a fast and efficient process. Once basic documents are shared, most cases are evaluated within a week or two. Decisions are made quickly, and disbursements begin soon after the agreement is signed.

There is also a belief that only financially distressed companies use litigation finance. That is no longer the case. Many profitable and well-funded companies now use it as a risk management tool. It allows them to use external capital to enforce legal rights while preserving internal funds for core operations and growth.

Finally, some worry about confidentiality. Professional funders are bound by confidentiality obligations and treat all client information with strict discretion. The process is secure, ethical, and legally enforceable, giving clients peace of mind.

How to Know If Litigation Finance Is Right for You ?

If you have a legal dispute and are unsure whether to pursue it due to high costs, litigation finance might be the right fit. Ask yourself: Is the case strong and backed by documentation? Is the potential financial recovery significant? Would I prefer a partner to shoulder the legal costs and risk?

If yes, litigation funding allows you to move forward with confidence. It removes cost concerns and puts your case in the hands of experienced professionals who are invested in the outcome, just like you are.

For businesses, the earlier you bring in a litigation funder, the better the strategic advantage. It improves legal planning, controls cost exposure, and allows you to litigate only the right cases, not just the ones you can afford. If used wisely, litigation finance can transform your legal function into a true business asset.

Conclusion: Litigation Finance Is Redefining Access to Justice

Justice should never depend on wealth. Third-party litigation finance brings us closer to a system where legal outcomes are decided on merit, not money. It breaks down the traditional barriers of cost, time, and fear that prevent people and businesses from asserting their legal rights.

For individuals, this model provides the courage and means to fight for what is right. For businesses, it introduces predictability, professionalism, and discipline into the way disputes are resolved. And for the legal ecosystem as a whole, it represents a more modern, commercially viable approach to justice delivery.

LegalPay is playing a key role in shaping this change in India. By providing outcome-based funding, legal strategy support, and complete transparency, it is empowering claimants of all kinds to take control of their legal journeys. With LegalPay, the cost of litigation is no longer a burden; it is an opportunity for resolution.

If you are staring at a legal dispute and are unsure about how to move forward, now might be the time to explore litigation finance. Because the real question is not whether you can afford to litigate, it is whether you can afford not to.

Frequently Asked Questions

What kinds of cases qualify for litigation funding?

Typically, commercial disputes, recovery matters, civil claims involving contracts, and arbitration cases with clear documentation and potential financial recovery are eligible.

How long does it take to receive funding once a case is submitted?

Most cases receive an initial response within one to two weeks. Complex cases may take slightly longer depending on the details provided.

Is repayment required if the case does not succeed?

No. Third-party litigation funding is non-recourse. If the case fails, the funder bears the cost, and there is no repayment from the client.

Will the funder interfere with how my lawyer handles the case?

No. Legal strategy always remains with the client and their lawyer. Funders are not involved in courtroom decisions.

Can litigation finance be used by defendants? Yes. Defendants can use litigation funding if the case involves significant legal costs and strong grounds for defense.

What happens if the case is settled before going to judgment? If a financial settlement is reached, the funder receives its agreed share as outlined in the funding agreement.

Is third-party litigation funding legal in India? Yes. Indian courts have accepted it as long as it does not affect the fairness of proceedings or breach any legal ethics.

Comments