How Lawsuit Financing Works and Its Benefits

- LegalPay

- Jul 23, 2025

- 9 min read

"Justice is open to all, just like the Ritz Hotel."

This witty quip by a 19th-century judge captures a hard truth about our legal system: access often depends on money. But in today's legal world, a rising innovation called lawsuit financing (LF) is changing the game. It empowers claimants to pursue legitimate legal actions without being shackled by exorbitant litigation costs.

Imagine a small manufacturer trying to recover dues from a multinational conglomerate, or a tech startup battling intellectual property theft by a deep-pocketed investor. In both cases, litigation is not just about justice; it's about survival. However, traditional bank loans are rarely a viable option. They require collateral, come with interest, and must be repaid regardless of the outcome. LF, on the other hand, provides a non-recourse alternative where repayment is conditional upon success. This makes it a lifeline for many litigants.

Globally, litigation finance has already taken root in markets like the United States, Australia, and the UK. In India, although still nascent, the demand is rising steadily, particularly after landmark judgments began to indirectly validate third-party funding. Legal startups and litigation funders are innovating new ways to provide flexible, ethical, and transparent financing for those who need it most. This blog unpacks how LF works, who it benefits, and why it may become a cornerstone of equitable justice in the years to come.

The Rise of Lawsuit Financing in India

As India witnesses an upswing in commercial disputes, contract breaches, and insolvency battles, the cost of justice continues to rise. According to the Ministry of Law and Justice, the average lifespan of a civil suit in India is over 5 years. This long haul translates into repeated court fees, legal retainers, expert witness charges, and administrative expenses.

The result? MSMEs, startups, and individual litigants are often forced to drop valid claims or settle prematurely. This is where LF enters as a saviour. With India's litigation finance market estimated to grow at over 20% CAGR over the next five years, it's evident that the demand for capital in legal proceedings is booming.

In 2023, a mid-sized manufacturing company based in Pune was entangled in a supply-chain dispute with a multinational corporation, valued at over INR 14 crore. Unable to match the deep pockets of the defendant, they opted for lawsuit funding. The case proceeded, expert lawyers were engaged, and by late 2024, the plaintiff won a favourable arbitration award. The funder received their agreed share, and the company walked away with justice and capital to grow further.

How Does Lawsuit Financing Actually Work?

Once a plaintiff approaches a litigation funder, the process kicks off with a detailed due diligence review. This involves evaluating the merits of the case, legal representation, value of the claim, enforceability, jurisdiction, and overall risk. On average, this initial assessment process takes between 10 to 21 days, depending on the complexity and documentation available.

If the case passes muster, a term sheet is offered outlining the amount of funding, expected returns, and other commercial terms. Importantly, this is a non-recourse arrangement if the plaintiff loses the case, they owe nothing back. The funder absorbs the loss, which incentivizes them to invest only in well-vetted, meritorious claims.

The funds provided can be used to pay advocate retainers, court fees, arbitration costs, expert witnesses, and even operational costs in some cases. For instance, in 2022, a Delhi-based logistics company secured litigation financing to sue a defaulting vendor in the National Company Law Tribunal (NCLT). With the support of the funder, they hired an experienced insolvency counsel and forensic experts. The case was resolved within 15 months with a favourable settlement of INR 3.2 crore. The litigation funder received their pre-agreed return, and the business remained financially stable throughout.

Throughout the process, funders maintain a non-interventionist approach. They receive periodic case updates but have no control over legal strategies, lawyer selection, or settlement decisions. This separation of control and capital ensures that the integrity of the legal process is maintained.

When the matter concludes successfully, the funder’s share is disbursed directly from the recovered amount, as outlined in the funding agreement. The remaining funds go to the claimant, often exceeding what they might have secured had they self-funded or compromised early. This model prioritizes justice and sustainability for litigants who would otherwise be priced out of the legal system.

Legal, Ethical and Strategic Advantages of Lawsuit Financing

Critics sometimes raise concerns around the ethics of third-party funding, but most are rooted in outdated assumptions. Reputable litigation funders comply with confidentiality norms, do not influence litigation tactics, and operate within clear legal frameworks.

From a strategic lens, LF offers multiple advantages:

Level playing field: It enables smaller litigants to go head-to-head with large entities.

No financial burden: Plaintiffs don’t have to mortgage assets or divert business funds.

Better settlements: Claimants can hold out longer, leading to improved negotiation power.

Quality representation: Access to top-tier legal teams improves the chances of winning.

Moreover, Indian courts are slowly opening up to the concept. The Delhi High Court, in the 2024 case of Belvedere Resources DMCC v. OCL Iron and Steel Ltd., acknowledged the role of third-party funders and emphasized the importance of transparency in funding arrangements.

Transforming Justice for MSMEs and Startups

Startups and MSMEs, which form the backbone of India’s economy, are particularly vulnerable in legal conflicts. Often underfunded and underrepresented, these businesses find it difficult to enforce contracts or recover dues through the courts.

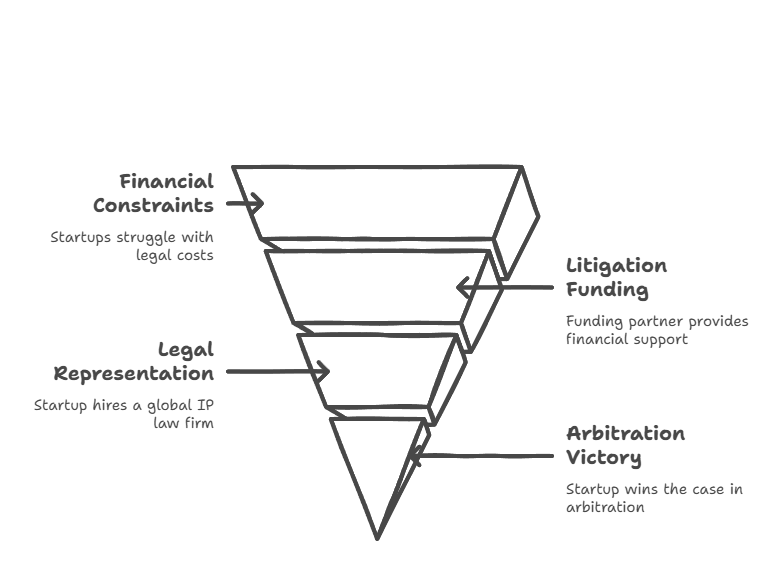

LF has emerged as a silent enabler. Take the example of a SaaS company in Bengaluru, which faced a prolonged intellectual property theft battle against a foreign investor. Legal costs were expected to cross INR 80 lakhs. Through a litigation funding partner, the company secured finances to engage a global IP law firm and eventually won the case in a Singapore arbitration tribunal.

Without LF, the company would likely have backed out or accepted a poor settlement. Instead, it retained both its innovation and its dignity.

The Future Outlook: Lawsuit Financing as a Catalyst for Legal Reform

As India embraces more institutional arbitration and commercial courts, the need for alternative legal funding models will only grow. Experts forecast that third-party litigation finance in India could evolve into a USD 1 billion industry within the decade.

The Securities and Exchange Board of India (SEBI) and Insolvency and Bankruptcy Board (IBBI) are also examining how regulated funding can improve outcomes in insolvency litigation and class actions.

In this changing landscape, LF is more than a funding solution; it’s a legal equalizer. It ensures that justice is not delayed or denied due to lack of resources, making the judiciary more accessible, efficient, and inclusive.

Driving Legal Accessibility Through Financial Innovation

The importance of legal financing goes beyond individual victories. It pushes the boundaries of financial inclusion within the justice system. For decades, wealth and influence were strong determinants of legal success. LF helps dismantle that imbalance.

Legal funders act like silent partners in a claimant's journey, offering capital and confidence at a time when both are in short supply. Their involvement gives plaintiffs not only the means to litigate but also the courage to persist. This shifts the dynamics of justice: from survival to strategy, from compromise to confidence.

More importantly, LF invites systemic change. As this model gains mainstream traction, we can expect litigation funders to be held to uniform standards, potentially overseen by bar councils or regulatory bodies. This would further boost trust and transparency in the ecosystem.

In the coming years, combining legal innovation with financial accessibility will be key to reforming India’s justice delivery mechanisms. The growth of LF is just one powerful step in that direction.

Conclusion

We hope this blog has helped you understand how LF works and why it’s emerging as a crucial tool in India’s legal economy. From enabling underdog litigants to take on legal giants, to supporting startups in their fight for innovation rights, LF is redefining access to justice.

At LegalPay, we empower claimants to fight rightful battles without the fear of financial ruin. With a deep understanding of the Indian legal landscape and a robust risk assessment process, we offer fast, flexible, and non-recourse capital for commercial disputes, arbitration, insolvency, and beyond. Our team works alongside litigants and legal professionals to structure custom funding solutions that match the complexity of each case. Whether you're an MSME, a startup, or an individual claimant, LegalPay ensures that your right to justice is not determined by your bank balance but by the strength of your claim.

Because access to justice should be a right - not a privilege reserved for the wealthy.

Frequently Asked Questions (FAQs)

What is this alternative funding method for legal cases, and how does it differ from a regular loan?

This financial solution allows individuals or businesses to pursue legal claims without bearing the full upfront cost. Unlike traditional loans, this option doesn’t require collateral, personal guarantees, or monthly repayments. It's also non-recourse meaning if the case is lost, the recipient owes nothing. In contrast, a bank loan must be repaid regardless of the outcome and is based on creditworthiness.

This funding model relies solely on the merits and potential success of the case. It provides a safety net, especially for those who have strong legal claims but lack the capital to pursue them. It’s ideal for those looking to challenge larger opponents or sustain litigation over long durations. By aligning financial risk with the case outcome, it ensures fairness and accessibility in the justice system.

Who can apply for third-party legal funding in India?

Individuals, startups, and MSMEs involved in commercial, contractual, or arbitration-related disputes are typically eligible. What matters most is the strength and credibility of the case. Funders evaluate various parameters like documentation, enforceability, value of claims, reputation of legal counsel, and the ability to recover the awarded amount. High-stakes disputes such as shareholder conflicts, IP infringement, and insolvency claims often qualify. Those who lack the immediate financial resources but have a strong legal case with measurable damages stand the best chance of approval.

This model is especially empowering for underrepresented litigants who may otherwise be pressured into poor settlements. Applicants should ideally have legal representation already in place and access to relevant case materials. The goal is to level the playing field, allowing valid claims to move forward even without deep pockets.

What kind of expenses does this funding cover during a legal dispute?

The funding is versatile and can be tailored to the needs of the claimant. It usually covers advocate retainers, filing fees, arbitration costs, expert witness consultations, document analysis, and procedural expenses. In many cases, it also supports operational continuity ensuring that a claimant’s business doesn’t suffer while the case is ongoing. For instance, a Delhi-based logistics firm used external funding to pursue insolvency proceedings, hiring forensic auditors and a senior advocate. The case was settled for INR 3.2 crore, and the company remained financially secure throughout.

Funding can be disbursed in stages or lump sums, depending on case progress. This flexibility ensures that parties do not have to compromise their legal strategy or representation due to budget constraints. It ultimately empowers litigants to stay committed to the legal process without the looming burden of escalating costs.

How long does it take to get approval and receive funding?

The entire process from application to disbursement typically takes between 10 to 21 working days. It begins with a preliminary review, where claimants share case documents, legal opinions, and other relevant materials. The funder then conducts a thorough assessment to evaluate the strengths, risks, and potential returns of the case. If the case is found viable, a term sheet is issued outlining the commercial arrangement. Once both parties agree, a formal agreement is signed, and funds are released.

The speed of this process largely depends on the claimant’s readiness and clarity in documentation. Cases with complete pleadings and a clearly defined legal path usually move faster. Funders aim for efficiency because delays can impact legal timelines. For the claimant, early communication and transparency help in securing quick approval. Legal teams are also consulted to ensure smooth coordination during the funding lifecycle.

What if the case is lost after receiving this type of funding?

One of the key advantages of this model is that it carries no repayment obligation if the case fails. Since the capital is provided on a non-recourse basis, the financial burden shifts entirely to the funder. The claimant bears no personal or business loss, and there’s no pressure to repay from future income or assets.

This setup eliminates the fear of financial ruin if litigation doesn’t result in a win. It’s a critical safety net for startups and MSMEs that cannot afford to take financial risks during legal conflicts. The arrangement is strictly governed by a legal contract that outlines all terms in advance. This clarity ensures that claimants can proceed confidently, knowing they are not risking their own capital. For many, this assurance is the deciding factor that allows them to pursue legal justice they might otherwise avoid.

Will the funder interfere in my legal decisions or force a settlement?

Not at all. Funders operate strictly as financial backers, not strategic advisors. Once the funding is in place, they have no role in directing legal strategy, selecting counsel, or influencing case decisions. Their involvement is limited to receiving updates on case progress, which helps them monitor their investment. Ethical boundaries are clearly defined to ensure there’s no conflict of interest or compromise in legal integrity.

Courts in India, including the Delhi High Court, have acknowledged the importance of maintaining this separation. The claimant and their legal team retain full autonomy throughout the litigation. This model respects the independence of the judicial process while supporting it financially. You can pursue your claim with the same conviction and legal direction you intended just without the financial stress. It’s about empowerment, not control.

How does LegalPay assist claimants and legal professionals?

LegalPay is India’s leading platform dedicated to supporting commercial disputes through flexible, non-recourse funding. We partner with claimants, law firms, and corporates to provide smart capital for high-value litigation and arbitration matters. Our approach is simple: we fund the fight for justice, so you don’t have to choose between survival and accountability.

With deep experience in insolvency, shareholder disputes, construction claims, and more, our team evaluates cases quickly, confidentially, and thoroughly. We don’t interfere in your strategy, but we stand by your side offering speed, discretion, and legal-tech-backed support. Whether you’re an MSME chasing unpaid dues or a founder protecting IP, LegalPay ensures financial constraints never compromise your rights. From initial screening to disbursal, our process is seamless. We believe in creating access, empowering outcomes, and building a future where justice is based on merit not money.

Comments