From Filing to Funding: Your Legal Finance Roadmap

- LegalPay

- Jul 6, 2025

- 9 min read

"The cost of justice shouldn’t be a barrier to pursuing it. But without a plan, cost becomes the first hurdle."

If you’re a business owner, founder, or CEO grappling with overdue invoices, breached contracts, or defaulting partners, you're probably familiar with the frustrating paradox of litigation - you need money to recover money.

This is where many businesses stall. They have a strong case, clear evidence, and the will to act but legal fees, long timelines, and uncertainty hold them back.

What they often don’t realise is that access to justice doesn’t have to be self-funded. There’s a strategic, step-by-step roadmap from filing a claim to funding its legal journey, and this blog breaks it down without legal jargon, without fluff, and without financial fear.

Because smart legal finance isn’t about shortcuts. It’s about knowing how to walk the path with support.

Litigation Isn’t Just Legal - It’s Financial

Going to court isn’t only about right and wrong. It’s about risk and return. Legal action is an investment one that can either yield recovery or drain capital.

A recent industry estimate found that the average cost of litigating a mid-size commercial case in India crosses ₹12–18 lakhs, with timelines stretching between 18 to 36 months. Add unpredictability, and most businesses either delay the process or drop it entirely.

The result? Millions in outstanding dues go uncollected each year, not due to weak cases, but unfunded ones.

That’s why understanding how to fund your legal claim, whether partially or fully has become a critical part of modern business risk management.

Step One: Strength Lies in Preparation, Not Pressure

Every strong recovery journey begins with documentation.

Before approaching lawyers, courts, or funders, businesses must assess what they hold:

Are the contracts or purchase orders clearly defined?

Do the invoices match agreed deliverables?

Is there any written acknowledgment of liability?

Have there been reminders, notices, or promises to pay?

This is not about perfection - it’s about clarity.

One of the most common reasons litigations fall apart isn’t legal grounds, but poor documentation. A missing email trail or unsigned agreement can delay the process or weaken your claim.

In a recent case in the export sector, a mid-sized manufacturer based in Surat had multiple export consignments unpaid for six months. Despite their frustration, they hadn’t documented the delivery confirmations properly. Only after collating email confirmations, bank remittance screenshots, and shipping bills were they able to establish a defensible position, one that a legal funder could support.

Step Two: Choosing the Right Legal Route Isn’t Optional

Legal disputes don’t come with roadmaps - but they should.

Depending on the nature of the case, choosing the wrong route can lead to years of delay or dismissal.

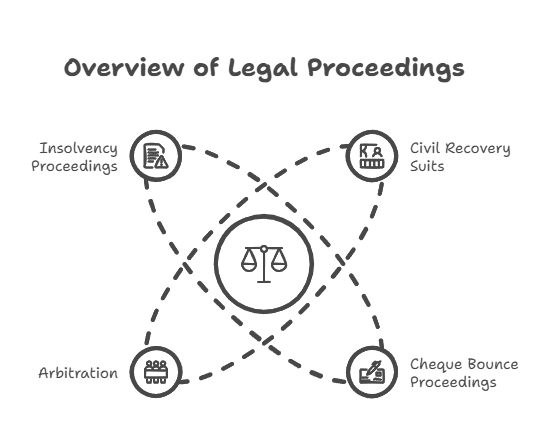

Here are some common choices businesses face:

Civil Recovery Suits: Useful for contract breaches, unpaid invoices, or service defaults. Requires robust documentation and a clear claim structure.

Cheque Bounce Proceedings (Section 138): If a cheque was issued and dishonoured, this route brings a criminal dimension and adds pressure, but only if process formalities are followed.

Arbitration: If your contract has an arbitration clause, courts will direct you there first. Faster, private, and enforceable but often underutilized.

Insolvency Proceedings: If the defaulter is a company and owes over ₹1 crore, you may be eligible to trigger the insolvency process, but this route is complex and needs strategic timing.

Legal funders and even lawyers often decline cases not because they lack merit, but because they’ve taken the wrong path or filed too late. Knowing where your case fits is half the strategy.

Step Three: Not All Legal Battles Need to Be Self-Funded

Here’s the turning point.

If your case passes legal viability meaning it's strong, timely, and well-documented but you lack the funds to pursue it, you're not out of options.

Legal finance or litigation funding bridges this gap.

Whether through third-party funding, partial cost coverage, or enforcement support, the key lies in finding:

A funder who understands your industry and claim value

A financial model that aligns with your risk tolerance

A team that balances aggressive pursuit with commercial sensibility

Real scenario:

A digital design agency in Bangalore had pending payments of ₹22 lakhs from a foreign client. Their contract had an arbitration clause, and the legal team quoted ₹6 lakhs to initiate proceedings. Lacking upfront funds, they partnered with a private funder who covered the costs. The agency recovered ₹19 lakhs via arbitration in less than 5 months.

Litigation funding, when done right, isn’t gambling. It’s a strategy-first investment in your claim.

Step Four: From Filing to Execution - Where Most Struggle

One of the most under-discussed phases of a legal journey is what happens after you win.

Securing a favorable order or decree is only part of the job. The real question is: can you enforce it?

The execution stage requires:

Locating debtor assets (bank accounts, properties, movable goods)

Applying for garnishee orders or attachment notices

Sometimes, sending recovery teams to initiate ground-level investigations

Many businesses drop the ball here either due to lack of awareness or lack of funds. A favorable judgment means little if there’s no recovery to show for it.

A food distribution company in Noida, for instance, obtained a ₹37 lakh decree after 18 months of litigation. But the debtor had closed their office and shifted operations under a new entity. The company then engaged in a legal intelligence firm that helped trace assets, leading to partial recovery through garnishee proceedings.

Enforcement isn’t about legal knowledge alone. It’s about actionable intelligence.

Step Five: Knowing When to Settle (and When Not To)

The most experienced legal teams know that settlement is not surrender.

In fact, the smartest recoveries often come from structured settlements where timelines, partial payments, and enforceable documents are signed under legal oversight.

But settlements should never be driven by desperation. They should be:

Documented (via notarised or court-monitored agreements)

Time-bound (with staged payments and legal triggers)

Backed by legal tools (such as post-dated cheques, consent terms)

Insight: A 2023 mediation survey showed that over 55% of business disputes in India were resolved through pre-litigation settlement when legal leverage was applied early through notices, pressure, or fund-backed intent.

Key Elements of a Legally Safe Settlement

Element | Purpose |

Notarised Agreement | Legal enforceability |

Timeline-Based Clauses | Structured recovery and follow-up |

Post-Dated Cheques | Leverage and legal fallback |

Consent Terms (if in court) | Closure and documentation |

The goal is not courtroom drama. The goal is recovery fast, fair, and final.

Step Six: Building a Repeatable Legal Risk Playbook

Once a business goes through the journey from filing to funding, it often emerges with a clearer view of what to avoid next time.

Building internal systems like better contract templates, payment term clarity, and follow-up timelines can reduce your legal exposure dramatically.

Businesses that create internal legal SOPs (standard operating procedures) are 3x more likely to recover dues without litigation. These include:

Sending formal reminders at defined intervals

Using demand letters with legal references after 30–45 days

Escalating via external counsel at the right time

Having a legal finance roadmap doesn’t just help you win disputes it helps you avoid future ones.

Conclusion

Legal action shouldn’t be postponed just because your balance sheet can’t support it today. With growing awareness around litigation finance, businesses can now pursue claims without upfront burden, relying instead on structured funding, strategic legal advice, and intelligent enforcement.

At LegalPay, we support businesses from the moment they decide to act not just by financing their litigation, but by ensuring each step is efficient, affordable, and outcome driven. If your business has a strong case and a clear claim, but lacks the resources to pursue it, we help you move from doubt to decision and from filing to funding.

Because your right to recover shouldn’t depend on your ability to afford it.

Frequently Asked Questions (FAQs)

What is litigation funding and how does it work in India?

Litigation funding is a financial model where a third party usually a professional funder provides upfront capital to cover the legal expenses of a case. In India, this concept is gaining traction among MSMEs, startups, and even large corporations who have strong legal claims but limited legal budgets. The funder pays for costs like court fees, lawyer charges, documentation, and enforcement. In return, the funder receives a share of the recovered amount if the case succeeds. If the case fails, the claimant owes nothing, this is called non-recourse funding.

The process typically begins with a case assessment to ensure legal merit and enforceability. Once approved, the funder remains involved during the litigation, providing both strategic and financial backing. Litigation funding allows businesses to pursue justice without risking working capital or draining operations, making it an ideal solution in India’s often time-consuming and expensive legal environment.

At what stage should a business consider legal funding?

Businesses should ideally consider legal funding early in the dispute resolution journey, just after assessing the viability of their claim and before incurring heavy litigation expenses. If you’ve already tried internal follow-ups, issued reminders, and collected documentation (like contracts, invoices, and acknowledgments), and the payment is still pending, that’s the time to assess if litigation funding is viable. Many companies wait too long, approaching funders after cases have already stalled or missed critical procedural steps.

The best time to consider funding is after documentation is ready and before formal legal action begins especially if you’re unsure about litigation costs or need help navigating legal remedies like civil suits, cheque bounce cases, or insolvency proceedings. Funders typically prefer cases where a legal roadmap is still flexible, enabling strategic input. The earlier you bring in funding support, the more value it can add not just in terms of money, but also legal direction and enforcement readiness.

What types of cases qualify for legal funding support?

Legal funders usually support commercial disputes with clear financial claims and enforceable documentation. These may include contract breaches, unpaid invoices, service defaults, dishonoured cheques, or supplier/vendor disputes. A funder’s interest depends on the recoverability of the amount and the strength of the legal claim.

Cases that qualify typically meet three criteria:

(1) well-documented transactions – like contracts, emails, delivery proofs

(2) evidence of default – like pending dues, non-payment records, etc. and

(3) a solvent or traceable debtor.

Some funders also support arbitration proceedings or insolvency cases (if the debt is above ₹1 crore and involves a corporate debtor). However, family disputes, criminal matters (except cheque bounce), or emotional torts usually don’t qualify. Funders are also cautious about cases that are too old or close to the legal limitation period. Ultimately, the case must make commercial and legal sense if it’s recoverable and well-documented; it likely qualifies for legal funding.

How is litigation funding different from taking a legal loan?

Litigation funding is fundamentally different from a legal loan. In a legal loan, the business borrows money and is obligated to repay it regardless of the outcome of the case. Interest may be charged, and the loan reflects as debt on the company’s books. In contrast, litigation funding is non-recourse; you only repay if the case is successful. If the claim fails, there is no repayment obligation.

This shifts the risk from the claimant to the funder. Additionally, litigation funders are typically more involved, they don’t just provide capital; they offer strategic support, legal tracking, and recovery enforcement. Legal loans are usually blind to legal strength or case progress, while funders vet and monitor every stage to protect their investment. As a result, litigation funding is a risk-sharing partnership, not a debt burden. For most businesses with cash-flow constraints and uncertain litigation outcomes, litigation funding is the safer and smarter alternative.

What documentation is needed to apply for litigation funding?

To apply for litigation funding, businesses need to present a strong and complete case file. Essential documents include:

Executed contracts or agreements

Purchase orders, invoices, or service reports

Communication proof (emails, WhatsApp chats, call logs, etc.)

Reminders or notices sent to the defaulting party

Cheques issued (if applicable) and bank bounce memos

Ledger accounts and bank statements showing pending dues

Debtor details (registered address, CIN, GSTIN if corporate)

If the dispute is already in court or arbitration, prior filings and court orders should also be shared. Documentation doesn’t need to be perfect, but it should clearly show a transaction took place, the obligation was not fulfilled, and the debtor has not resolved it despite reminders. The funder uses this to assess the claim’s merit, enforceability, and likely recovery timeline. The stronger your file, the faster and more confidently funding decisions can be made.

Can legal funding be used for enforcing judgments and decrees?

Yes, enforcement-only funding is a growing vertical in legal finance. Many businesses win court cases but fail to recover money because they can’t track the debtor’s assets or don’t have funds to initiate execution proceedings.

Legal funders step in at this post-judgment stage to finance:

Asset tracing and ground verification

Legal filings for garnishee orders and property attachment

Court-appointed receivers or recovery agents

On-ground intelligence teams to identify movable/immovable assets

Enforcement costs are often underestimated, and without timely execution, even strong decrees become symbolic wins. Funders assess the decree, validate whether the debtor has attachable assets, and then finance the enforcement process for a share in the recovered amount. This model turns paper victories into actual cash recoveries. If your decree is sitting idle due to lack of bandwidth or budget, enforcement funding can unlock its true value with minimal effort from your side.

7. What are the benefits of partnering with LegalPay for legal funding?

LegalPay offers litigation finance that’s strategic, structured, and success linked. As India’s leading litigation funder, LegalPay empowers businesses to pursue claims without upfront legal costs. What makes LegalPay different is its end-to-end approach, from pre-funding legal assessment and documentation support to court filing, tracking, and final enforcement.

LegalPay’s funding is non-recourse, meaning you only pay if the case succeeds, keeping your working capital safe. Its legal team and partner network ensure that every stage whether it’s sending demand notices, choosing the right legal route, or enforcing decrees, is handled smartly and professionally. LegalPay also brings in tech-enabled dashboards to monitor case progress, offer real-time updates, and manage document flow. Whether you’re an MSME, founder, CFO, or in-house legal head, LegalPay becomes your recovery partner, not just a financier. It turns overdue invoices into fundable claims and strategic legal outcomes. That’s the true power of modern litigation finance.

Comments